Subotiz Payments is Subotiz’s embedded and centralized payment solution that enables merchants to activate payment capabilities, complete compliance reviews, and move through a structured payment onboarding process within a single platform.

Through a standardized application and activation workflow, merchants can efficiently complete entity verification, business review, and payment enablement, ensuring compliant, secure, and sustainable payment operations.

Process Overview

After completing the required information at each step, click Next in the upper-right corner to continue. To reduce review back-and-forth, merchants are strongly encouraged to prepare all required materials in advance and submit accurate, complete information in a single session.

Submitting a Subotiz Payments Application

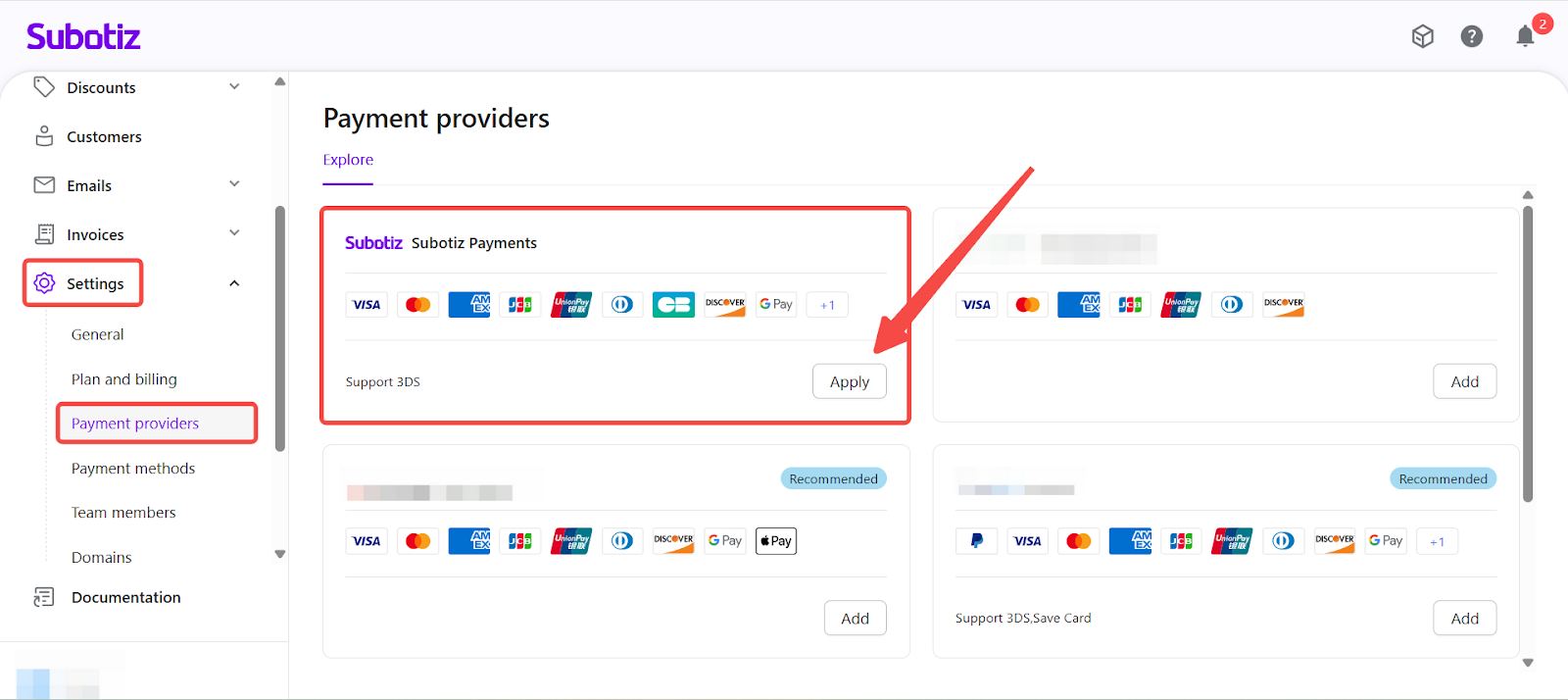

- Open the Payment Provider page: Navigate to Subotiz Admin > Settings > Payment Providers, select Subotiz Payments, and click Apply to begin the application process.

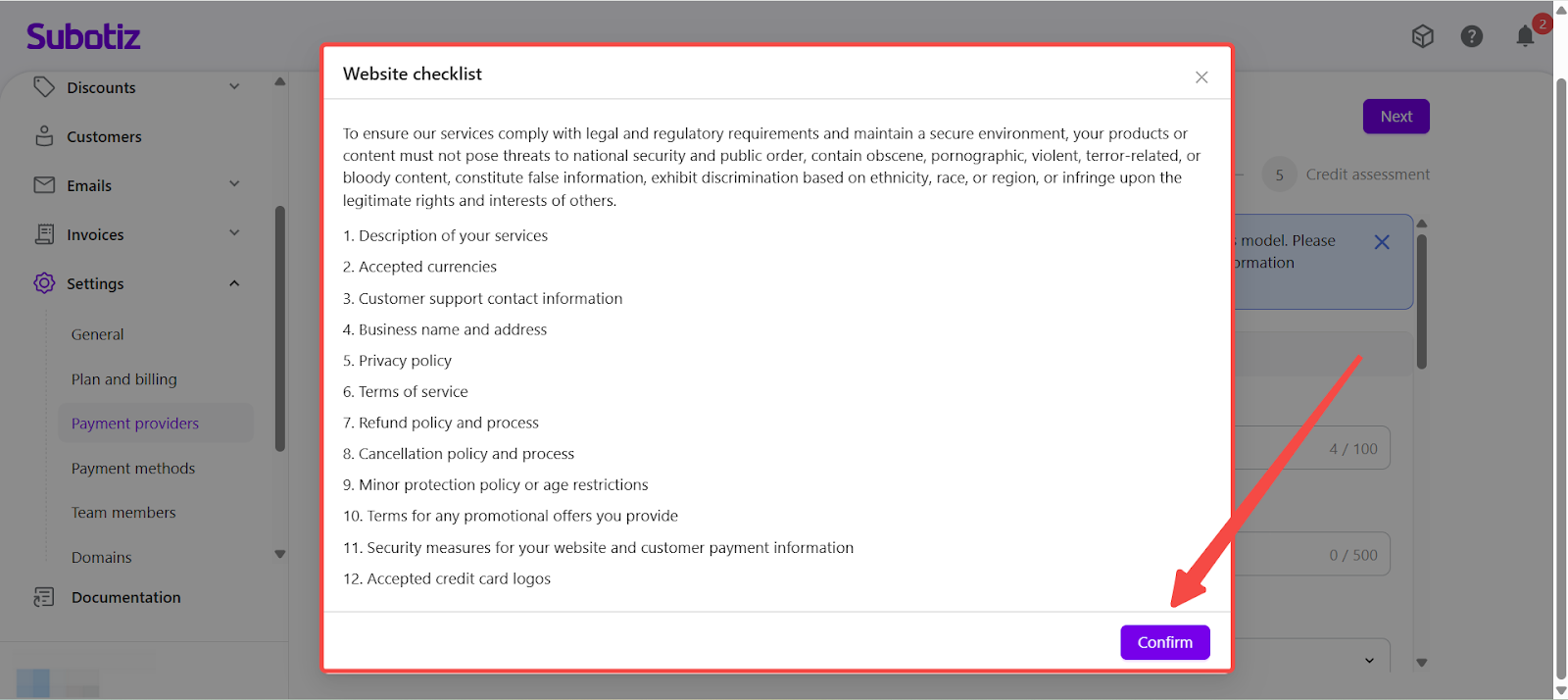

- Review the Website Checklist: As part of the application flow, the Website Checklist is displayed to help merchants review whether their website meets payment compliance and risk review requirements.

- Confirm that the website meets the following criteria:

- The official website is publicly accessible.

- Product or service descriptions are clear and accurate.

- Required policy pages are available (such as a Refund Policy and Privacy Policy).

- Website content is consistent with the actual business model.

- The Website Checklist is a required step in the Subotiz Payments application process and supports compliance and risk review readiness. Incomplete content, inconsistencies, or inaccessible pages may result in a request for additional information or application rejection.

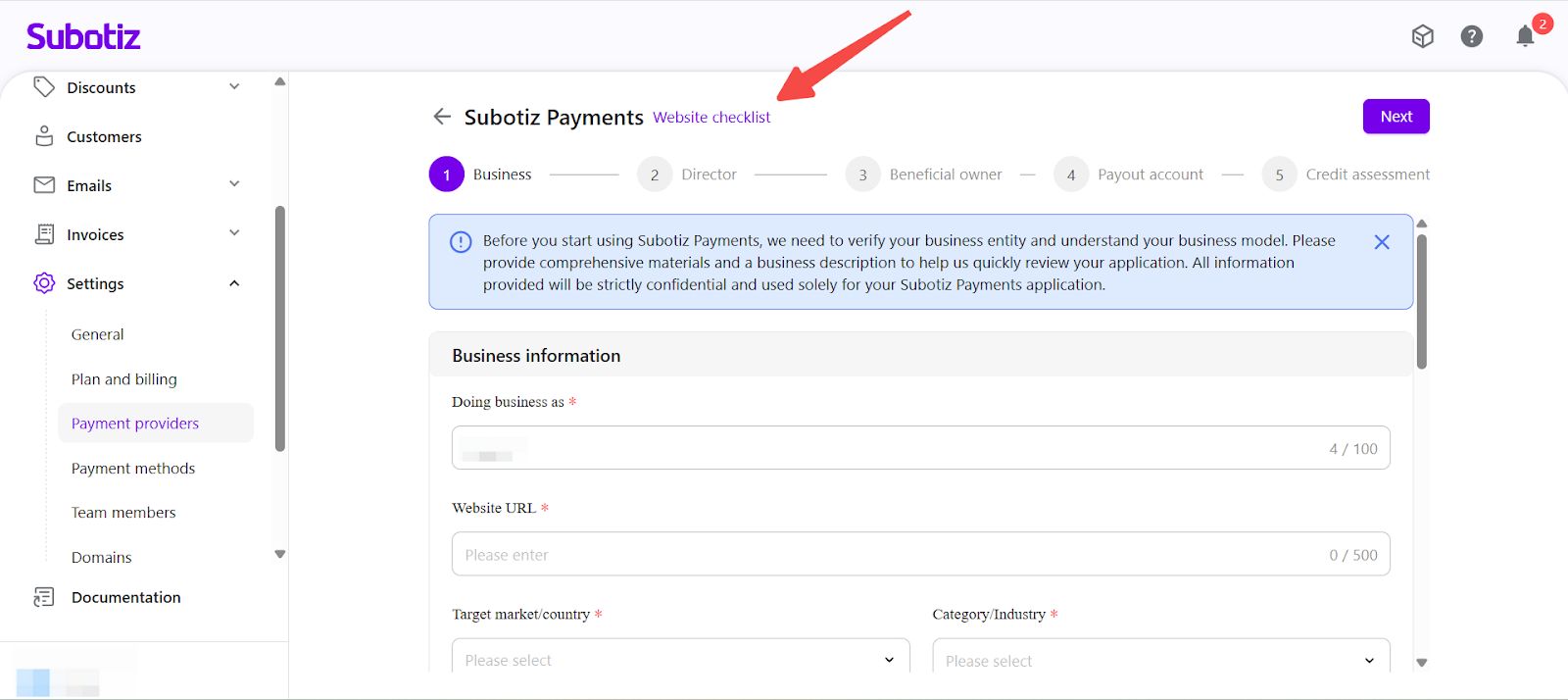

- The Website Checklist remains accessible at the top of the application page throughout the process for reference.

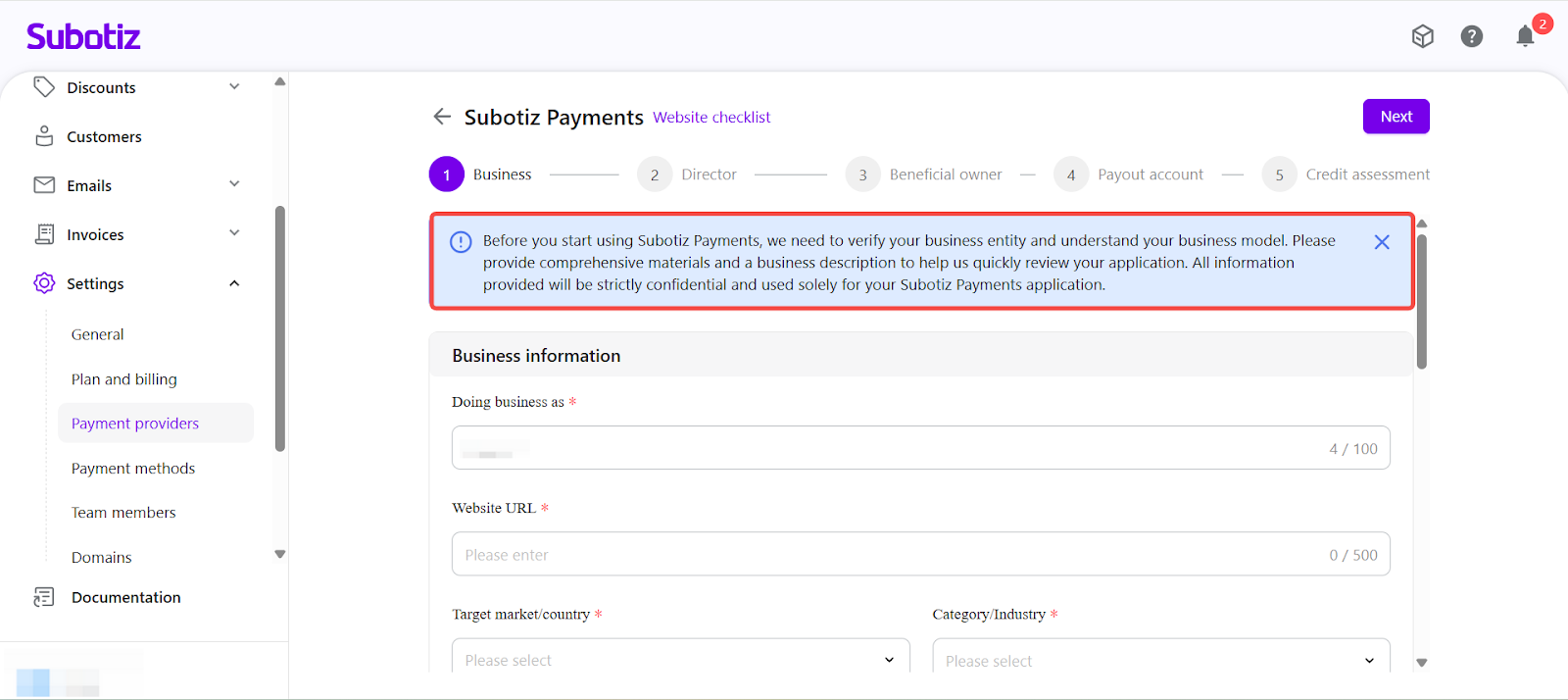

- Review application guidance: Following the Website Checklist, the system displays an application guidance notice explaining why business information is required and how it will be reviewed.

- Subotiz Payments needs to verify the business entity and understand the business model before enabling payment capabilities.

- Clear business descriptions and supporting materials help facilitate an efficient review process.

- All submitted information is used solely for the Subotiz Payments application and is handled confidentially.

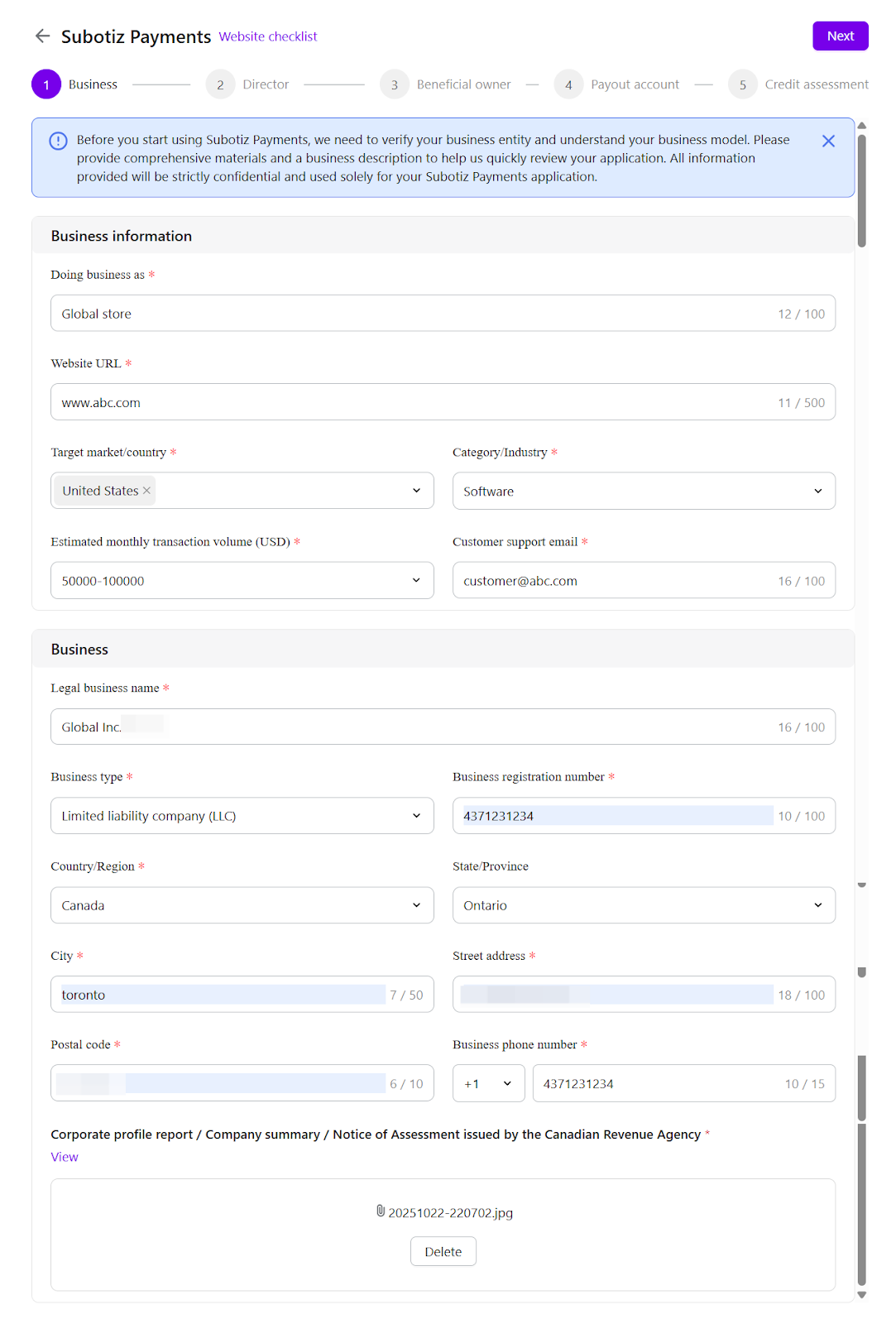

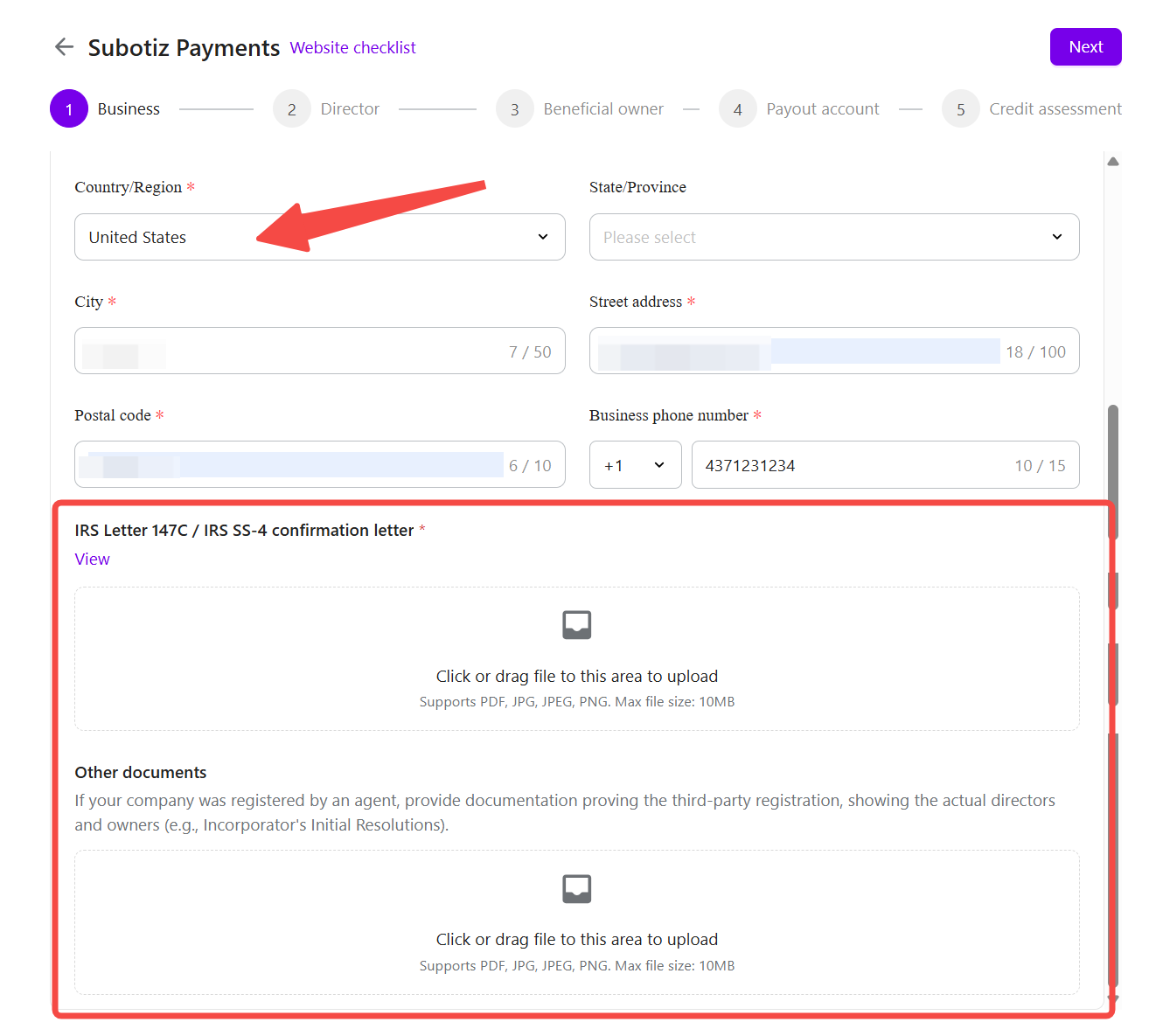

- Submit business information: Provide core business details, including:

- Official website URL.

- Business model and product description.

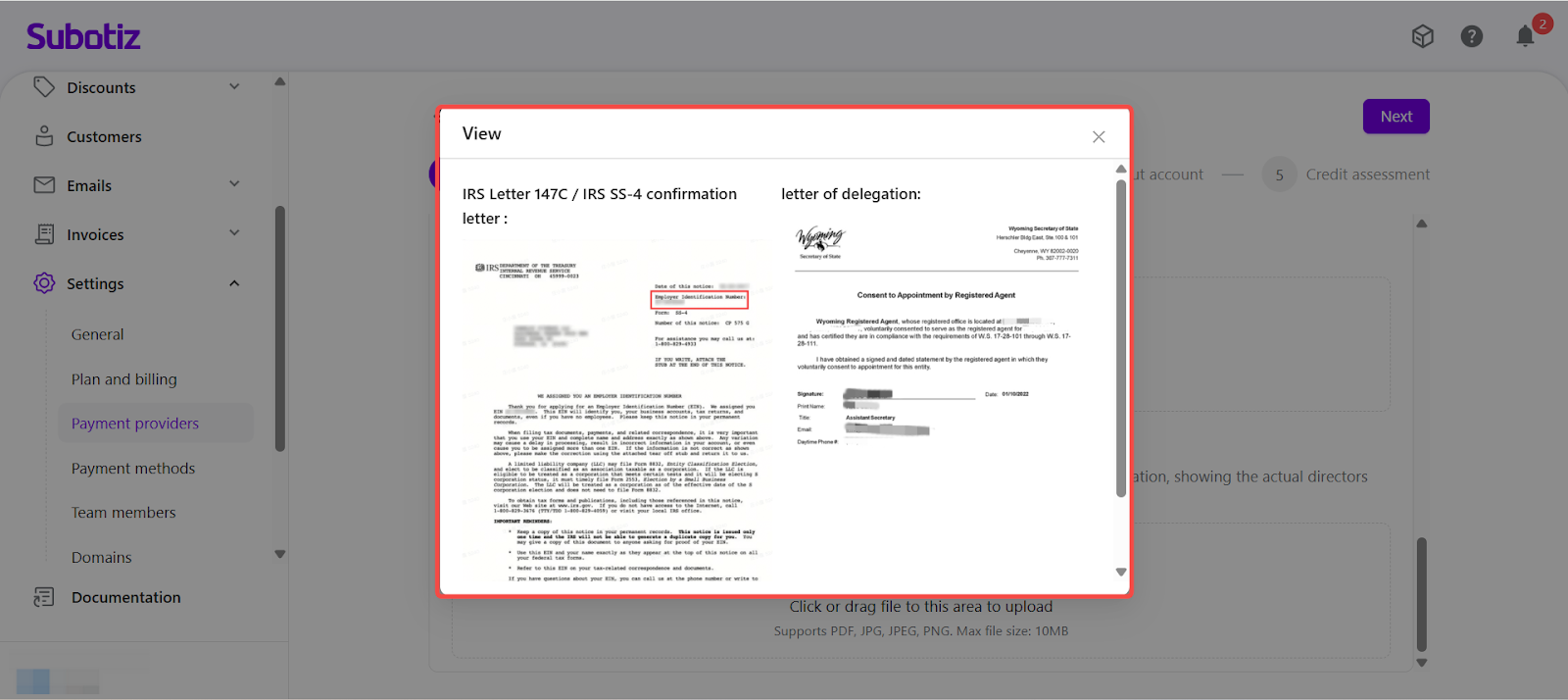

- Business registration or incorporation documents.

- Notes:

- Required documents may vary by jurisdiction and entity type.

- Follow on-screen instructions and upload sample documents as requested.

- All files must be clear, legible, and complete.

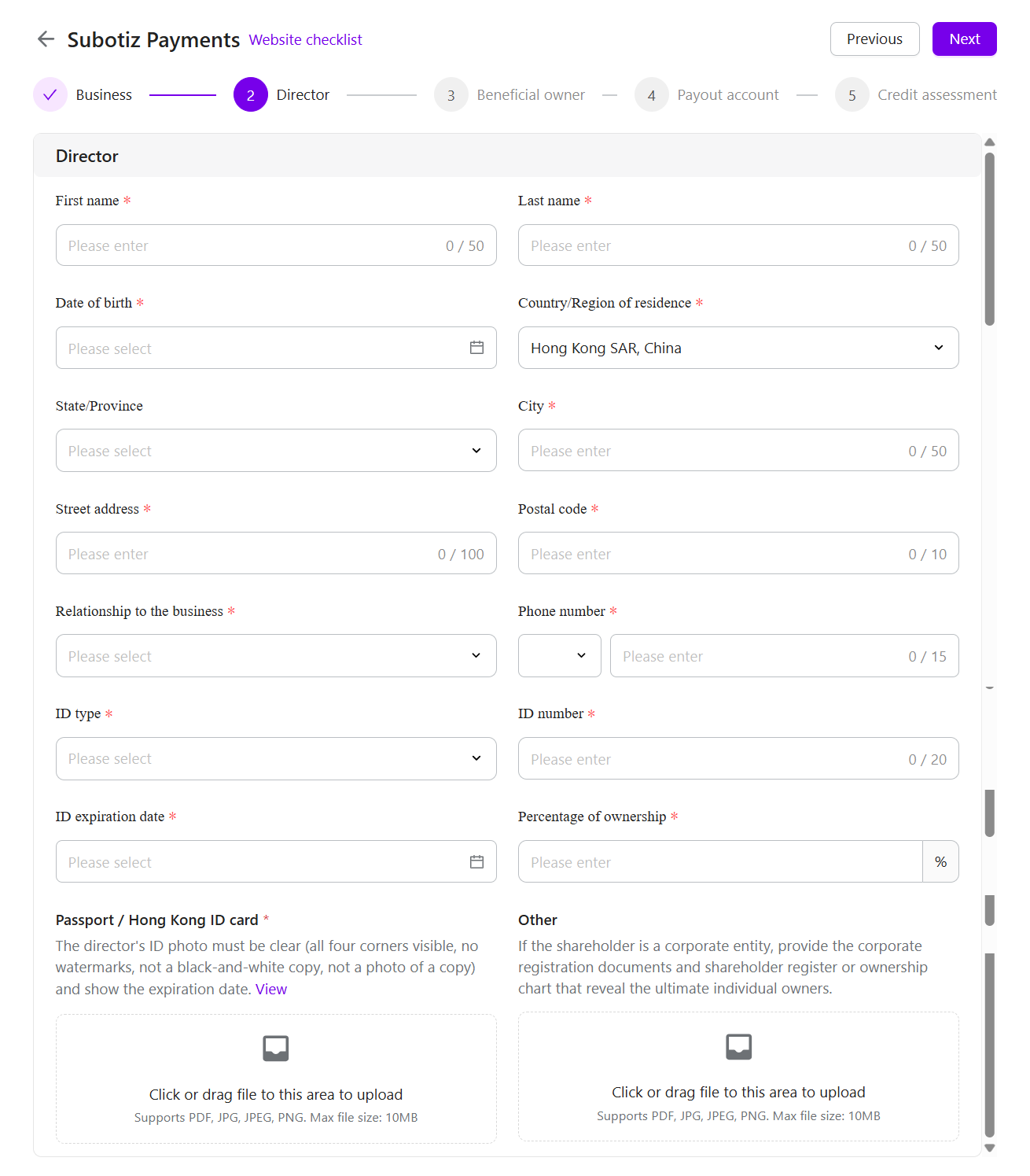

- Provide director information: Enter information for company directors or key management personnel and upload the corresponding identification documents.

- Director information is required to:

- Confirm company governance and decision-making authority.

- Complete regulatory identity verification.

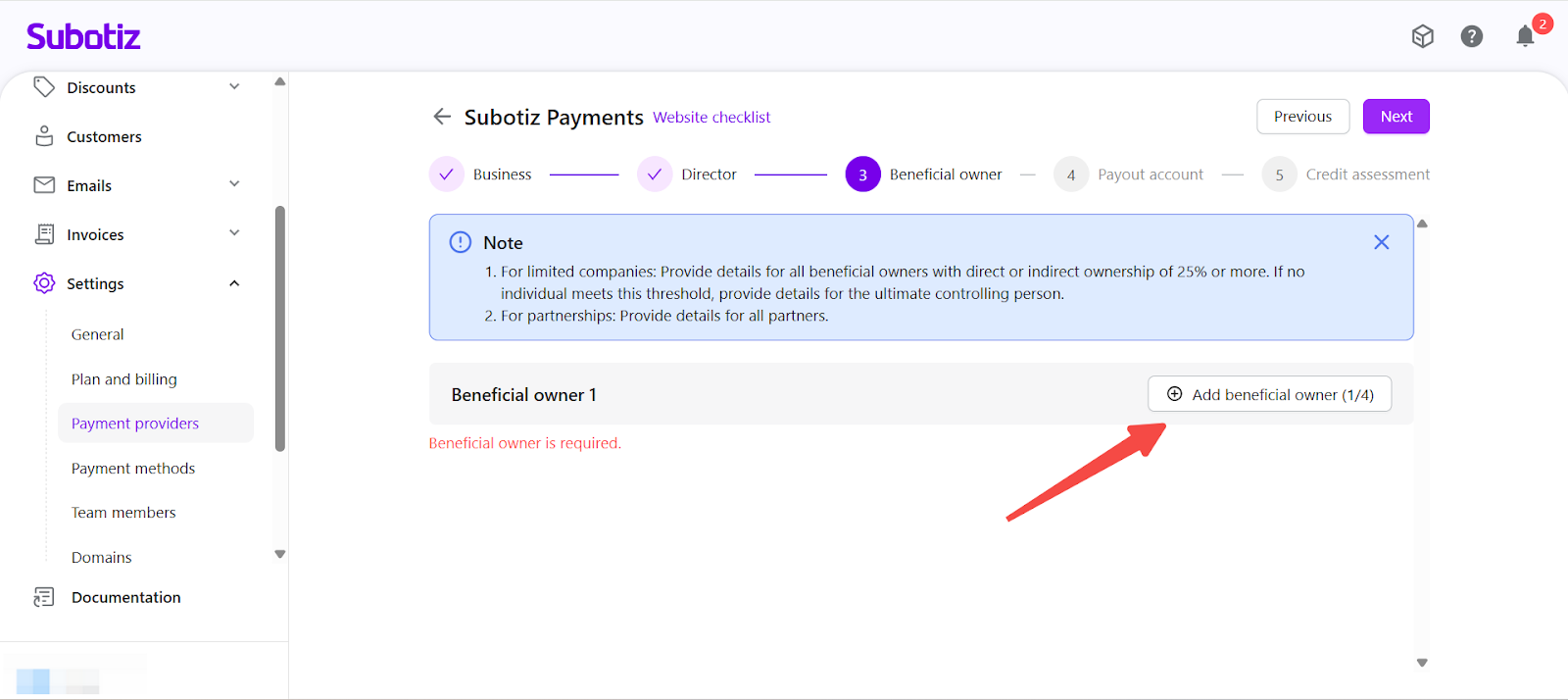

- Submit beneficial owner information: Provide details for individuals who have ultimate ownership or control over the company.

- Rules by entity type:

- Corporations

- List individuals who directly or indirectly own 25% or more.

- If no individual meets this threshold, list the ultimate controlling person.

- Partnerships

- All partners must be listed.

- Limits:

- A maximum of four beneficial owners can be entered.

- If there are more than four, prioritize individuals with significant ownership or control.

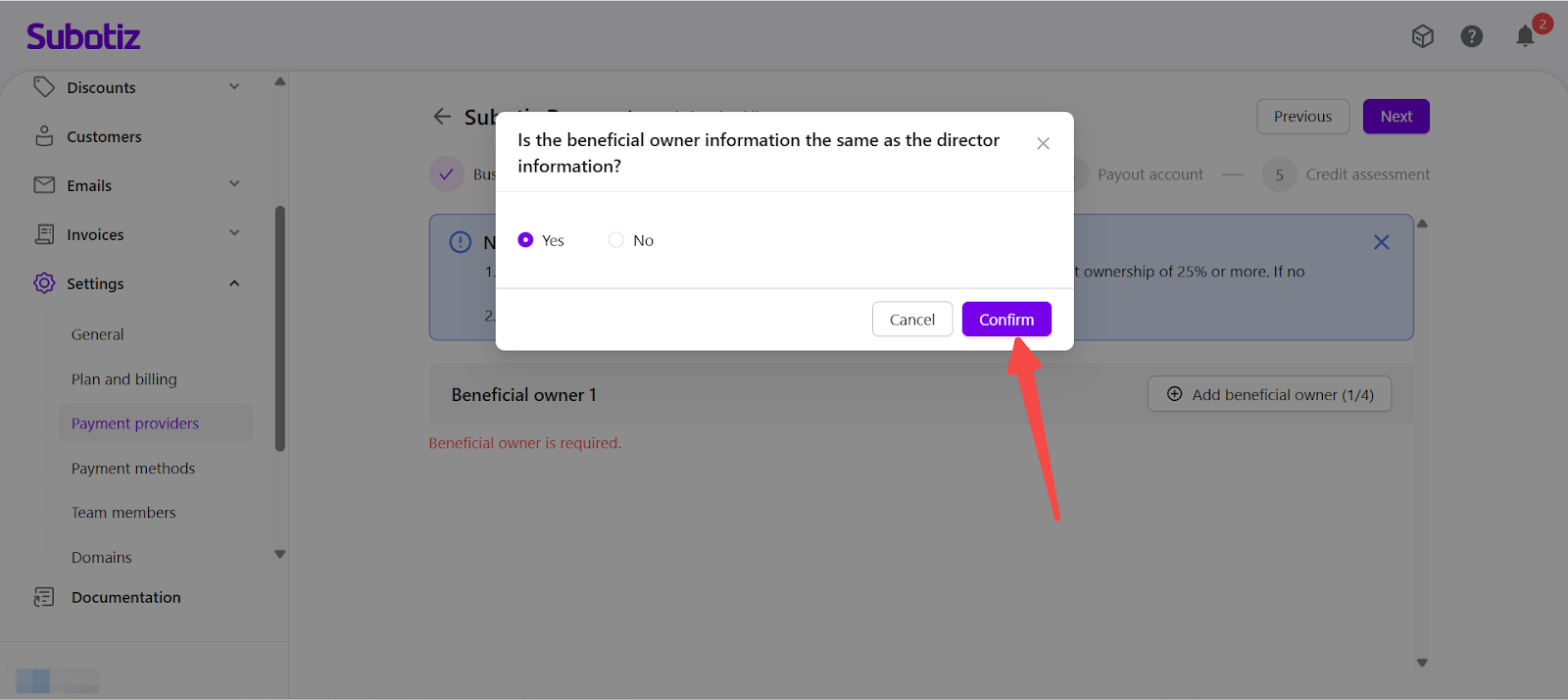

- Quick entry: If a beneficial owner is also listed as a director, you may use Copy Director Info to populate the fields automatically.

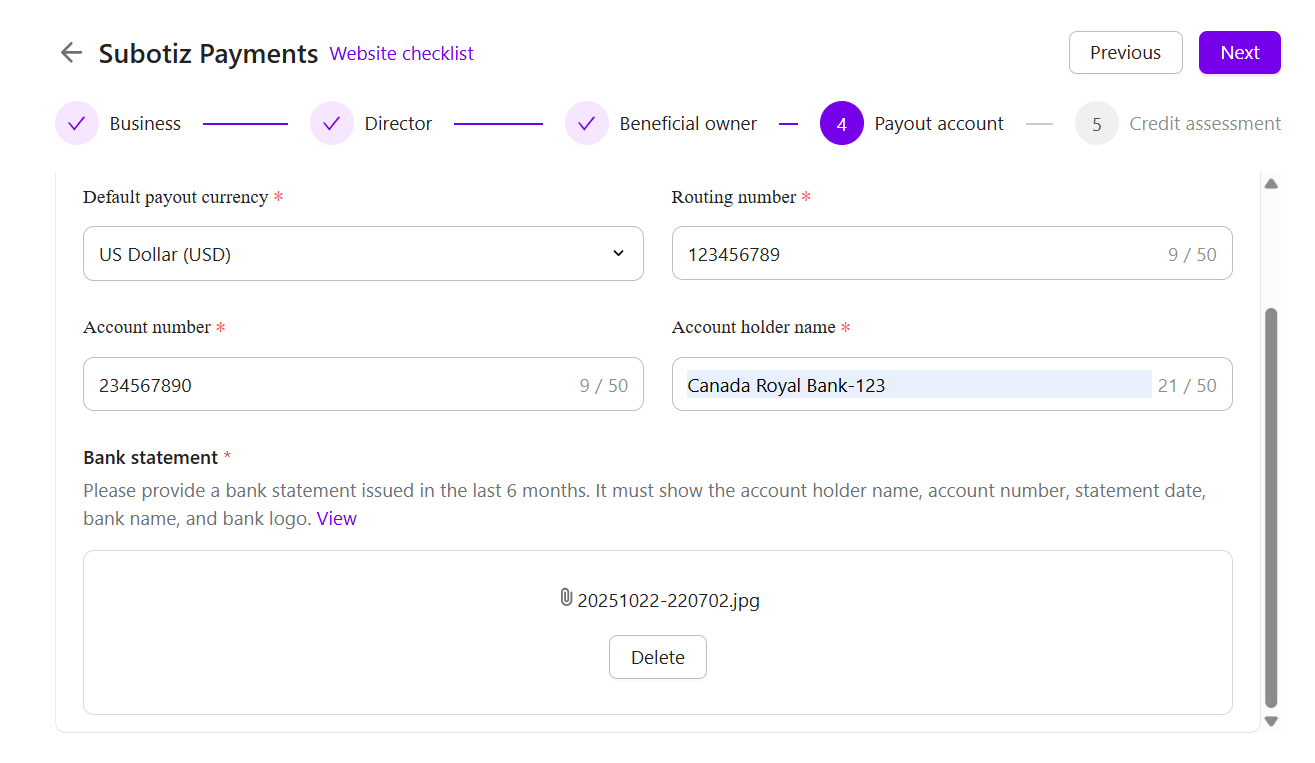

- Set up the payout bank account: Enter the bank account information used to receive settlement payouts and upload:

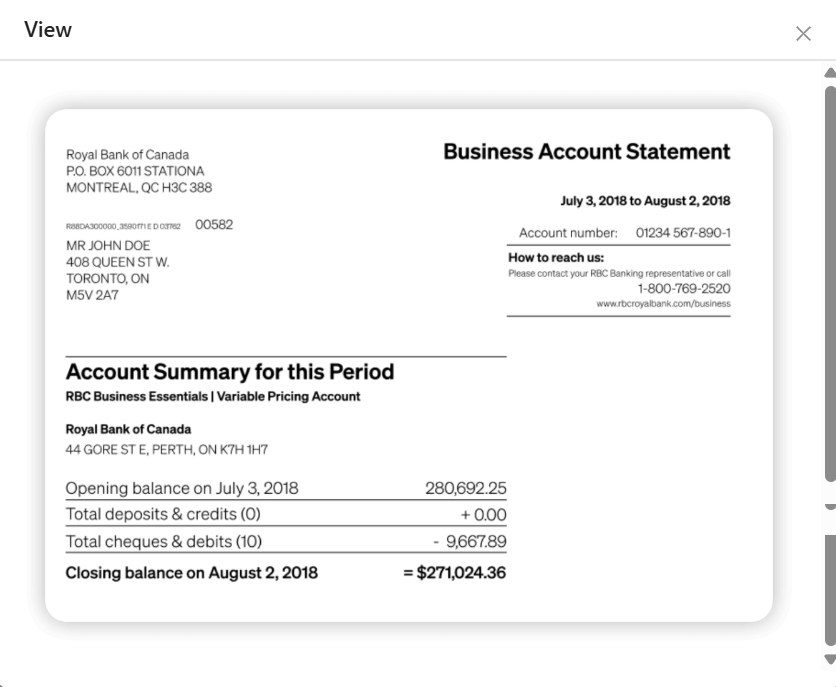

- A bank statement issued within the last six months by the receiving bank.

- Important requirements:

- The bank account country or region must match the company’s registered jurisdiction.

- The statement must clearly display the account holder name, account number, and bank information.

- If the account holder name does not match the company entity, or required details are unclear, resubmission may be requested.

- New accounts: If a six-month bank statement is unavailable, a screenshot from the bank’s online portal may be accepted as an alternative, provided it clearly shows:

- Account holder name

- Bank account number

- Bank name or official branding

- Acceptance is subject to final review.

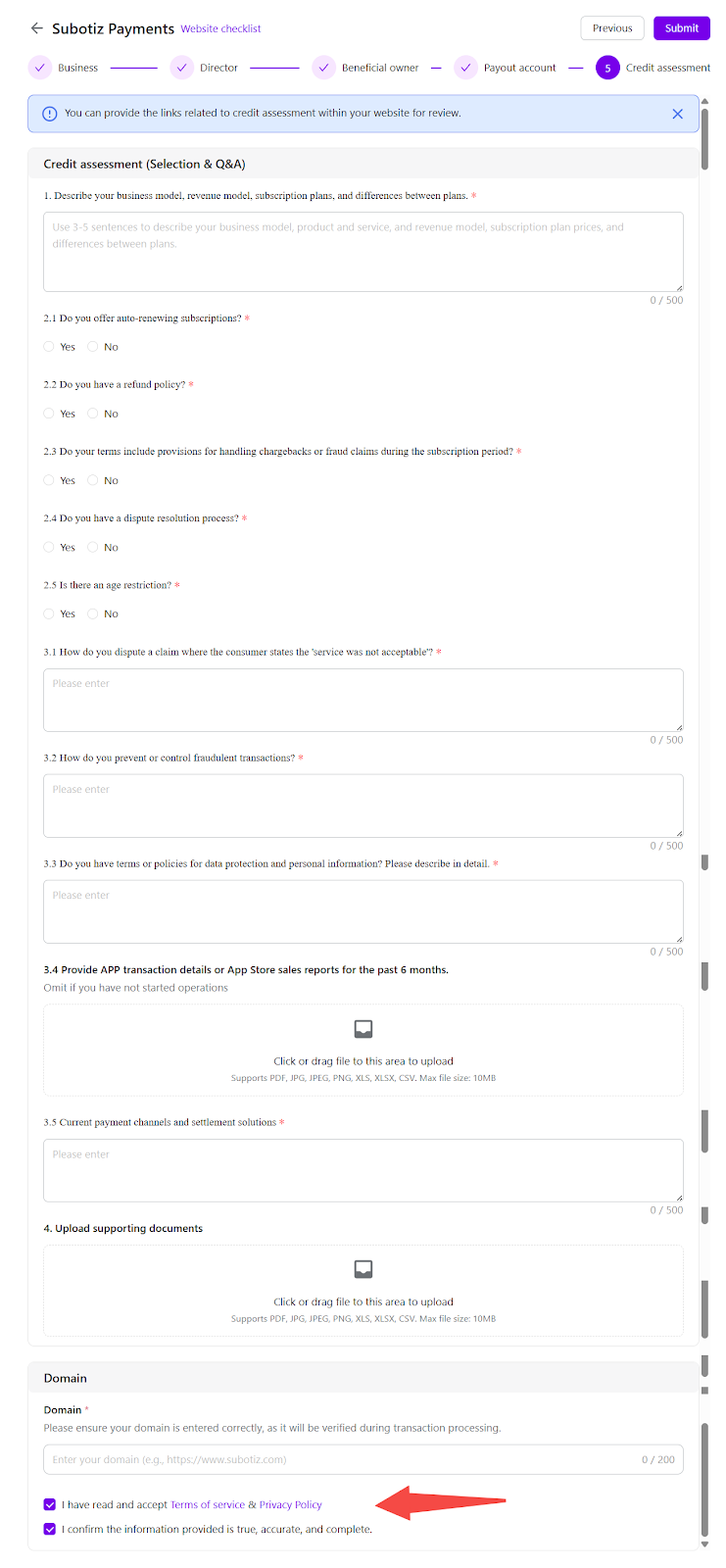

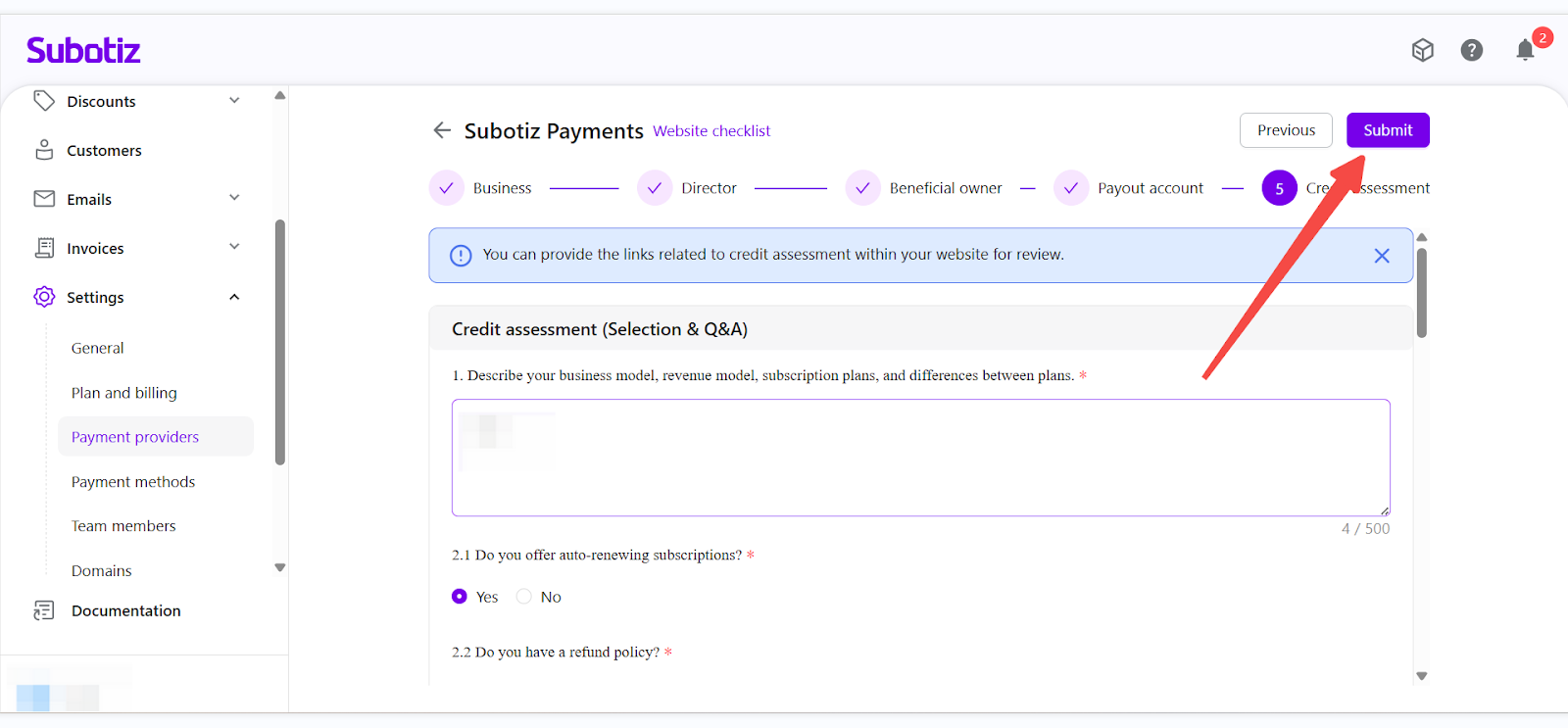

- Submit credit assessment materials and accept agreements: Provide relevant links or materials related to transaction volume and business operations for credit assessment.

- You have read and agreed to the Service Terms and Privacy Policy.

- You confirm that all information provided and materials uploaded are true, accurate, and complete.The application cannot be submitted unless both acknowledgements are selected.

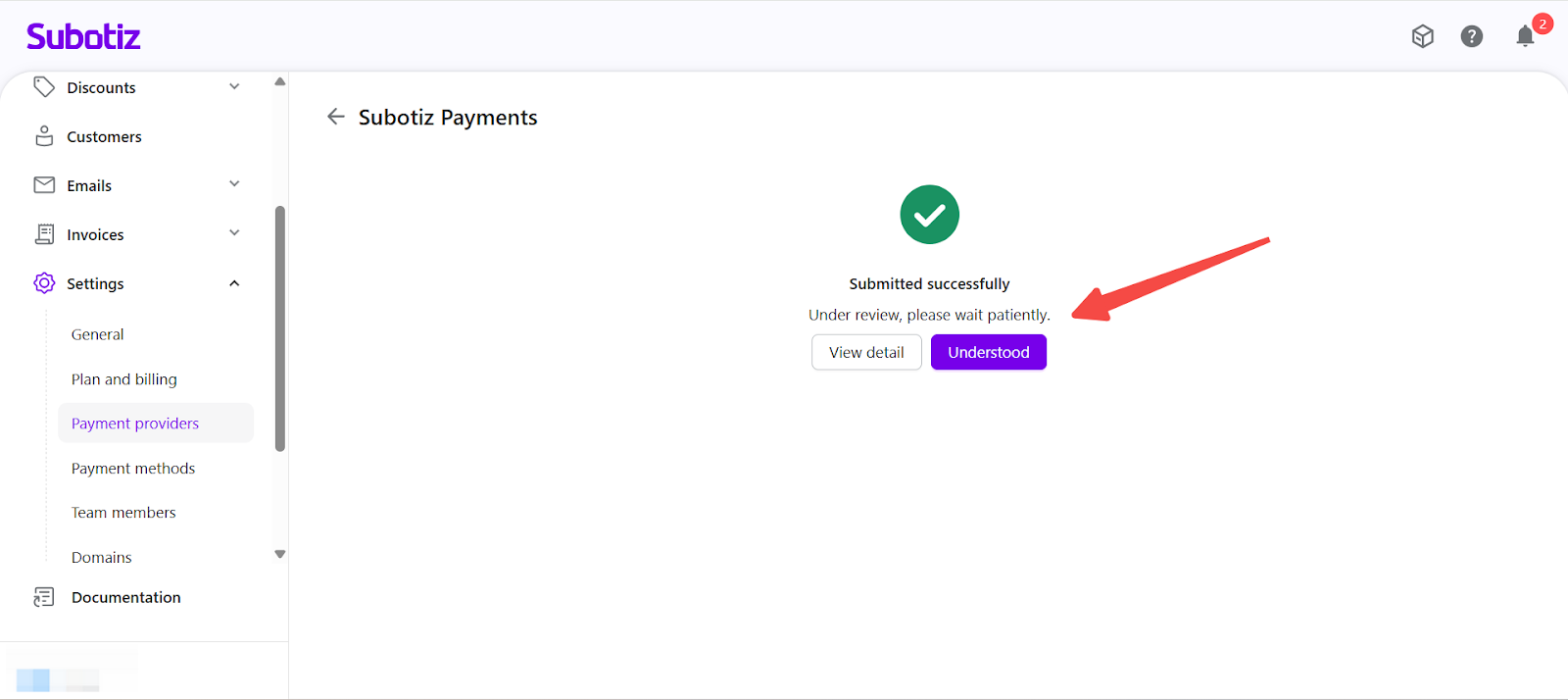

- Confirm and submit: Review all information for accuracy, then submit the Subotiz Payments application. Once submitted, the application will enter the review process.

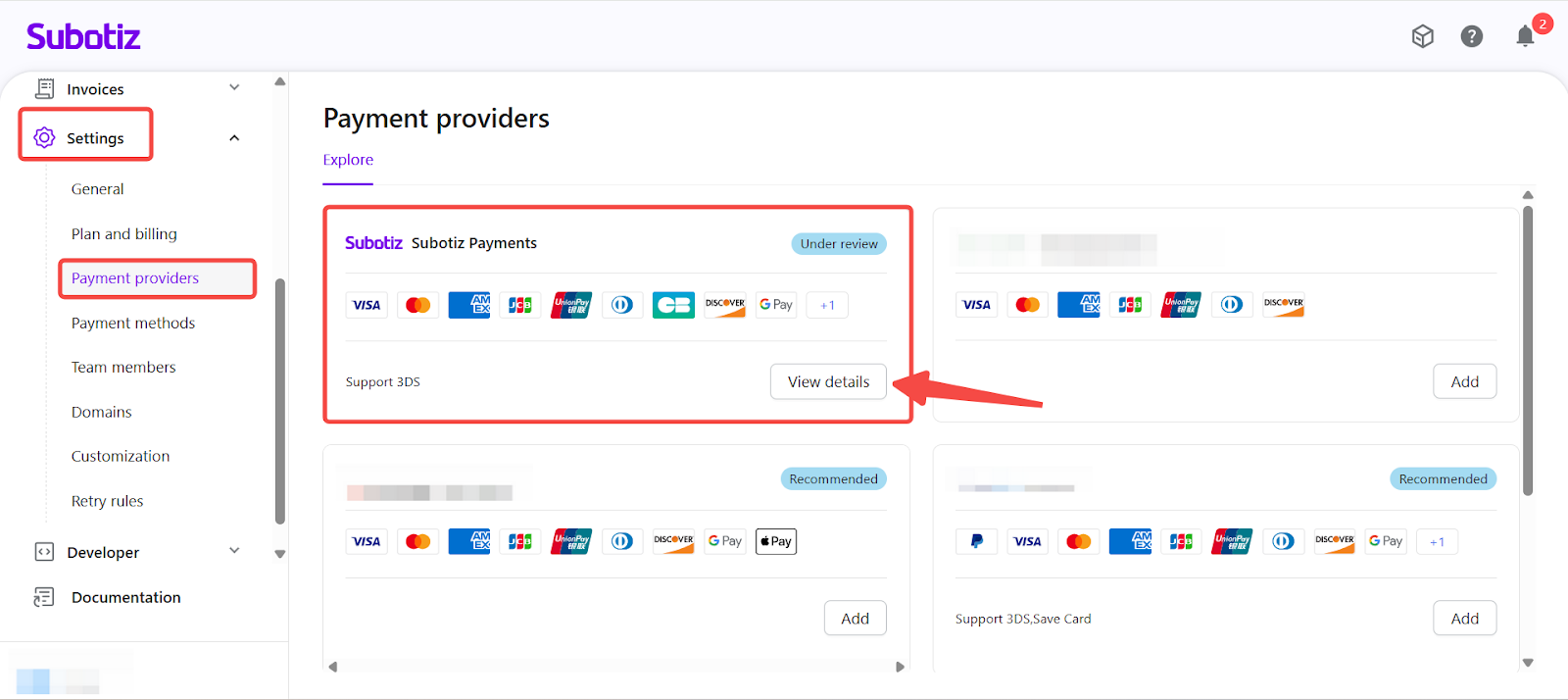

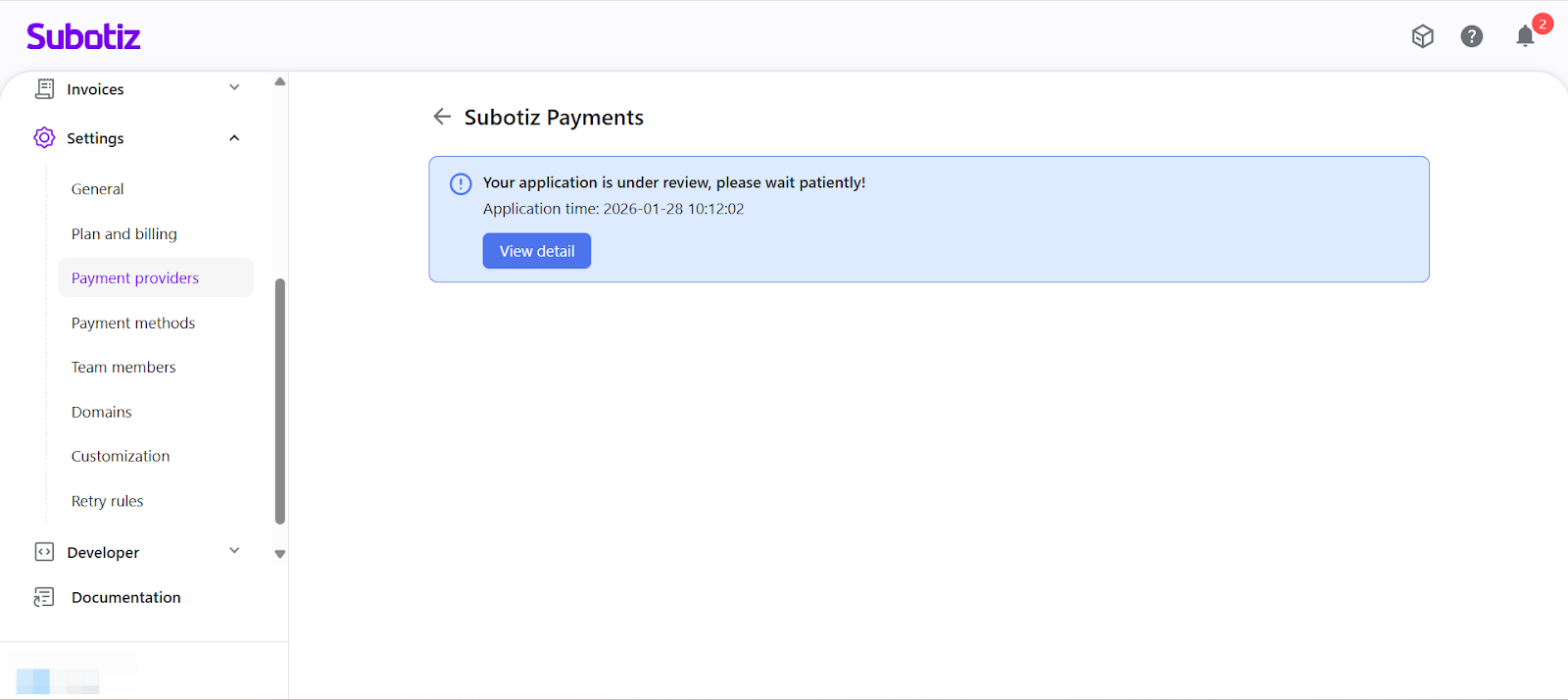

Checking Application Status

- Check status: Navigate to Settings > Payment Providers > Subotiz Payments, then select View details to check the current application status and review progress.

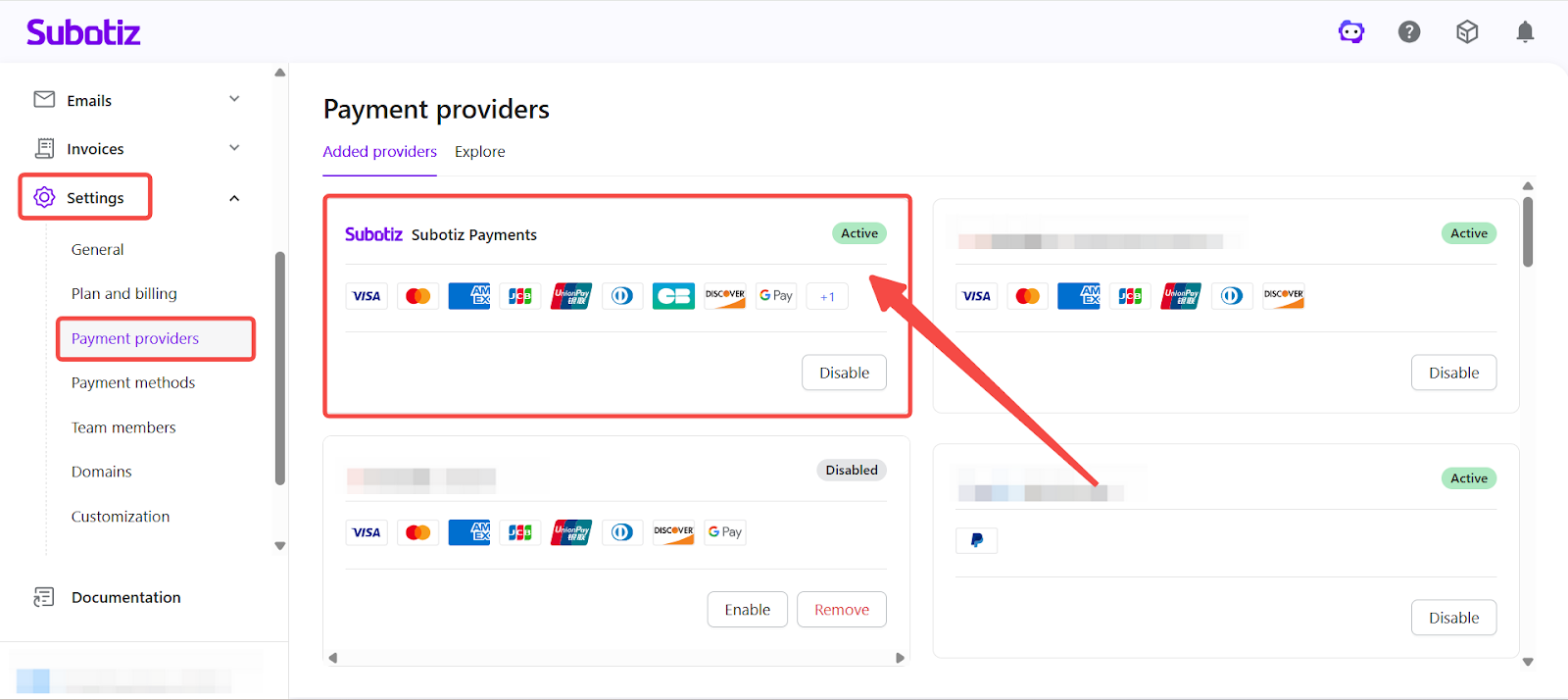

Approval and Payment Activation

- Automatic activation: Once approved, Subotiz Payments is automatically activated. No additional action is required.

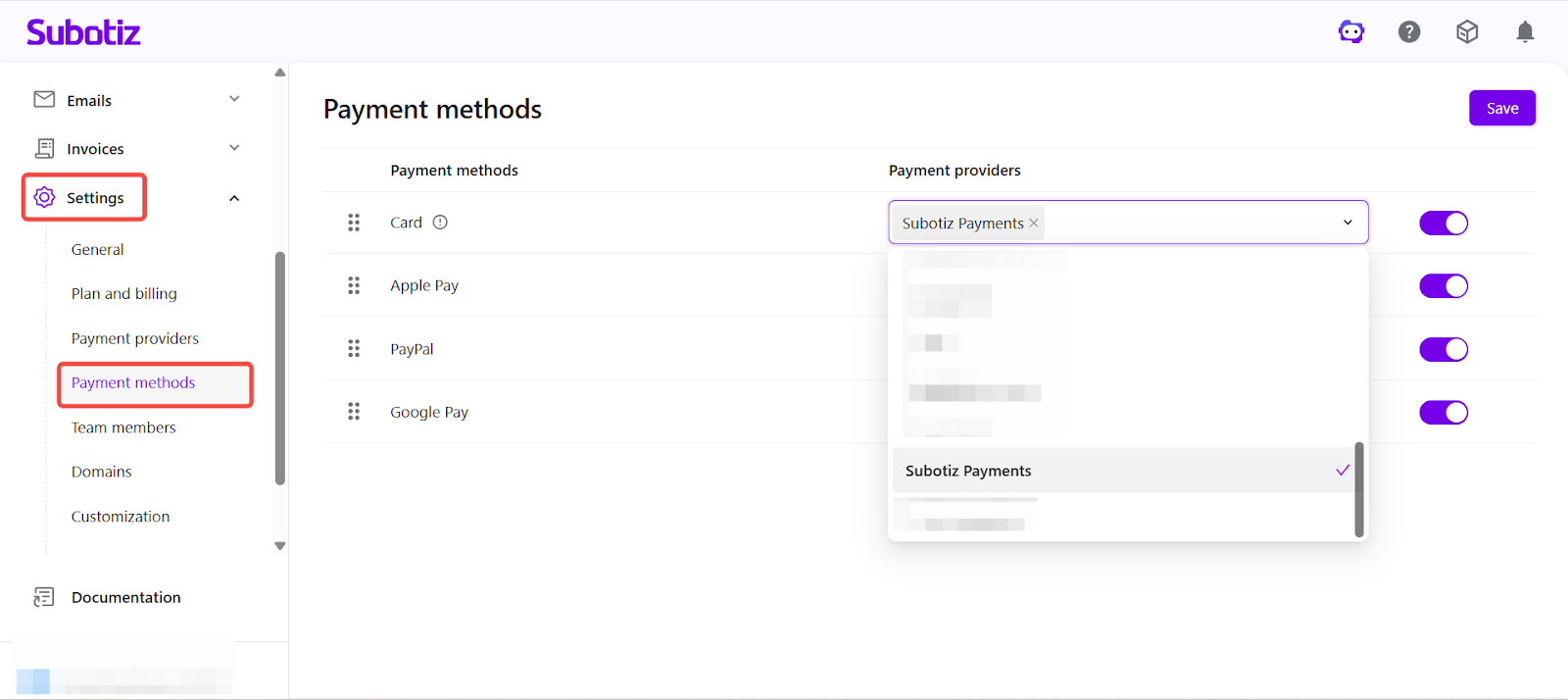

- Enable payment methods: Go to Settings > Payment Methods, select the desired payment methods, and click Save.

- Merchants can configure payment methods based on:

- Target markets

- Business model

- Customer payment preferences

Application & Review Notes

- Preparing complete and accurate information in advance can significantly reduce review time.

- Website content that does not match the actual business model may delay or block approval.

- Business, director, and beneficial owner information must remain consistent.

- Incorrect payout account details or mismatched regions may delay settlement and activation.

By following the standardized Subotiz Payments application and activation process, merchants can complete payment onboarding, compliance review, and payment method configuration with confidence, while establishing a secure foundation for long-term growth and cross-market expansion.